Venture Debt vs. Venture Capital: A Comparative Analysis

When seeking funding for a startup, the choice between venture debt and venture capital can be daunting. Both options offer unique advantages, and understanding their key differences is crucial for making an informed decision.

Venture Debt

- Definition: A loan provided to startups, typically with higher interest rates than traditional bank loans.

- Key Features:

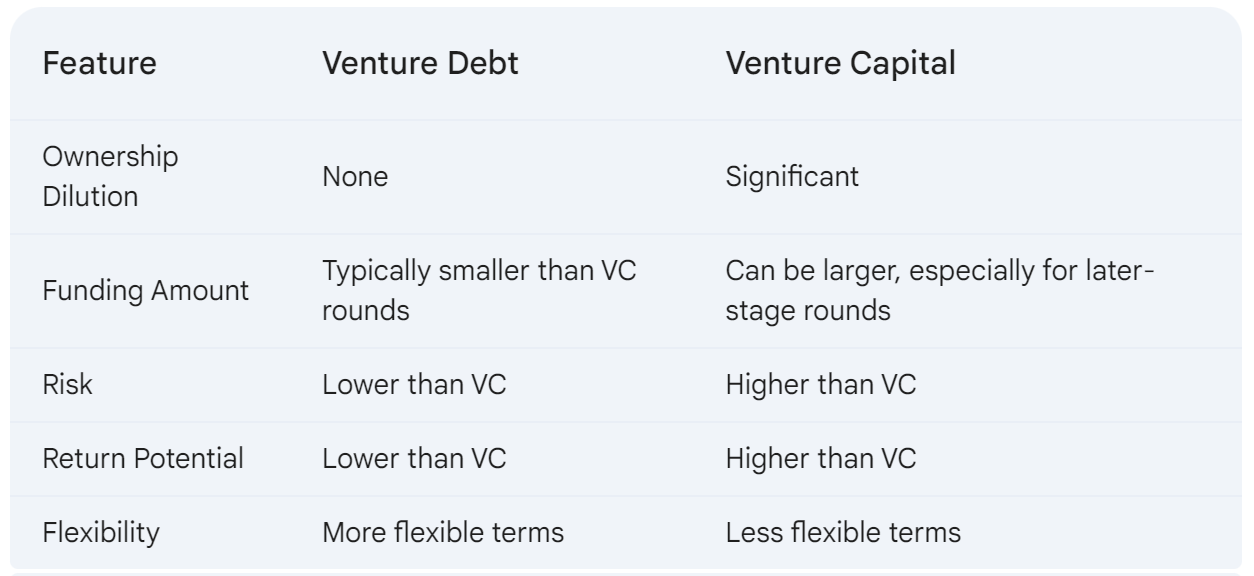

- Non-dilutive financing: Doesn't require giving up ownership equity.

- Flexible terms: Can be tailored to the specific needs of the startup.

- Often comes with warrants: Options to purchase equity at a predetermined price.

- Ideal for: Startups with a proven track record, seeking capital for growth without diluting ownership.

Venture Capital

- Definition: Equity investments made by venture capital firms in early-stage companies.

- Key Features:

- Significant equity stake: VCs typically acquire a substantial ownership stake in the company.

- Active involvement: VCs often provide mentorship, networking, and strategic guidance.

- Higher risk, higher reward: VC investments carry higher risk but also offer the potential for significant returns.

- Ideal for: Startups in early stages of development that require substantial capital for growth and innovation.

Choosing the Right Option

The best funding option for your startup depends on several factors:

- Stage of Development: Early-stage startups may find VC more suitable, while later-stage companies can explore venture debt.

- Risk Tolerance: Your comfort level with ownership dilution and potential financial risks will influence your choice.

- Growth Plans: If you need capital for rapid growth or expansion, VC might be a better fit. For more incremental growth, venture debt could be a viable option.

- Financial Health: Your company's financial performance and projections will impact your eligibility for both VC and venture debt.

Remember:

- Combination: It's possible to combine venture debt and venture capital to create a balanced funding strategy.

- Professional Advice: Seek guidance from financial advisors or venture capital firms to make an informed decision.

By understanding the nuances of venture debt and venture capital, you can choose the funding option that best aligns with your startup's goals and maximize your chances of success.

References:

- Silicon Valley Bank: https://www.svb.com/startup-insights/venture-debt/how-does-venture-debt-work/