Four Essential Metrics for Your Startups

In today's fast-paced business world, tracking and measuring key metrics is essential to stay ahead of the competition. Understanding how your business is performing and where to focus your efforts is crucial to making informed decisions and driving growth.

Whether you're a startup just getting off the ground or an established business looking to stay ahead of the curve, having a solid understanding of essential metrics is a must. In this guide, we'll explore the most important metrics for businesses of all sizes and provide tips on how to track and interpret them effectively. By taking a data-driven approach to managing your business, you can make informed decisions, drive growth, and achieve long-term success.

The Inevitable Shift

The tech industry shifted its focus in 2022 from unrestrained growth to prioritizing profitability. In uncertain times, startups and expanding businesses must ensure their financial stability, which is crucial for success without relying heavily on external funding. To do so, creating a cost-efficient structure and cultivating healthy economic performance is vital.

While metrics differ for each business, these metrics provide insightful diagnostics to evaluate growth and profitability: Cash Burn Rate, Customer Acquisition Cost, Incremental Profit Margin, and Pre-S&M Profit Margin.

These are the essential metrics that all business owners should be aware of in order to successfully maintain the well-being of their businesses:

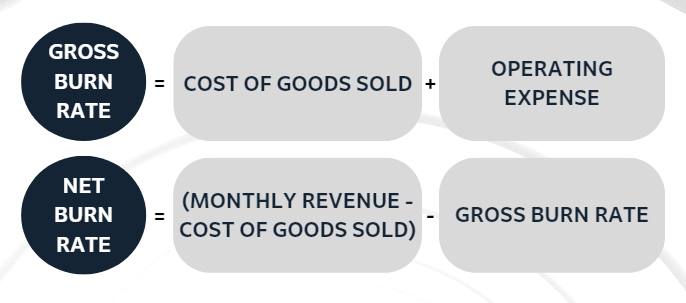

Cash Burn Rate

This metric measures the efficiency of cash usage during the company's growth phase. The Burn Rate refers to the speed at which a company is using its cash. In the context of cash flow negative start-ups, it indicates the rate at which their equity funding is being depleted.

Customer Acquisition Cost (CAC)

CAC refers to the total expenses a company incurs in acquiring a new customer. This includes expenses such as marketing, advertising, sales and any other costs associated with acquiring a new customer. Understanding a company's CAC is important for planning and allocating capital, as well as assessing the effectiveness of marketing and sales efforts.

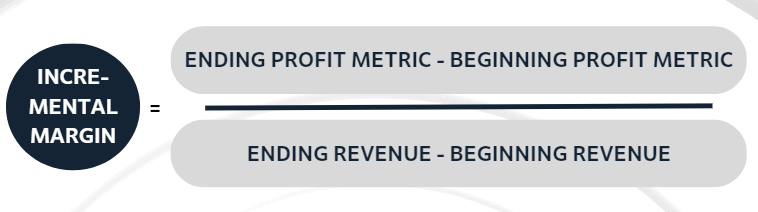

Incremental Profit Margin

It tracks the company's progress toward profitability and shows how much revenue is converted into operating profit. A margin above 20% signals healthy progress, while a margin below 10% calls for a closer examination of the cost structure.

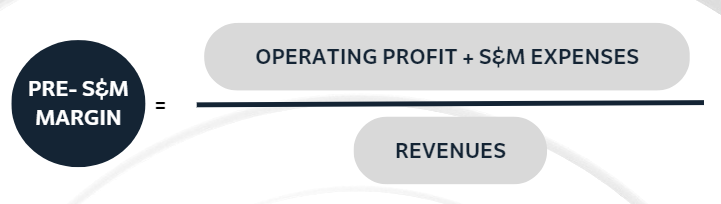

Pre-Sales and Marketing Margin

This metric allows you to measure the profitability before investment in sales and marketing. A margin of 20% or more is considered healthy, and a margin above 40% is best-in-class. The trajectory over time is more important than the absolute number in evaluating this metric.

When looking at a company's expenses, keep in mind that there are also many details to consider and there may be times when things don't follow the usual pattern.

During good economic times, these metrics may not get the attention they deserve. However, right now it is crucial to pay attention to them as maximizing the use of funds has once again become a top priority for almost all businesses.